Global M&A deals flourished in 2021. Deal activity rebounded from the COVID-19. According to Wall Street Journal, the total value of mergers and acquisitions (M & M&A) in 2021 was $5.7 trillion, 64% higher than before. However, persistent inflation may contribute to a softening in equity markets and a higher cost of capital due to interest rate hikes in 2022.

The outlook for 2022 was overwhelmingly positive as companies across sectors used M&A to navigate technological change and the growing importance of environmental, social, and governance (ESG) themes. Unprecedented PE fundraising, especially by the most significant funds, lays the foundation for forthcoming M&A activity. However, recent geopolitical tension and inflation have led to lower M&A activity in Q1.

Germany is creating M&A opportunities through digitization and sustainability. In general, deals in transport, infrastructure, healthcare, technology, financial services, aerospace and defence, energy and real estate have played a key role in shaping the M&A landscape in 2021.

Moving forward, there were also interesting cross-border deals in many different sectors. These include apparel and footwear, travel and tourism, consumer goods, oil and gas, food services and mining.

M&A Deals in Europe

What were the drivers of M&A deals in 2021? As Pitchbook states, a perfect mix of strong capital markets, rapid vaccine deployment, easing of pandemic-related restrictions, and persistent accommodative policy were the major factors driving the M&A boom.

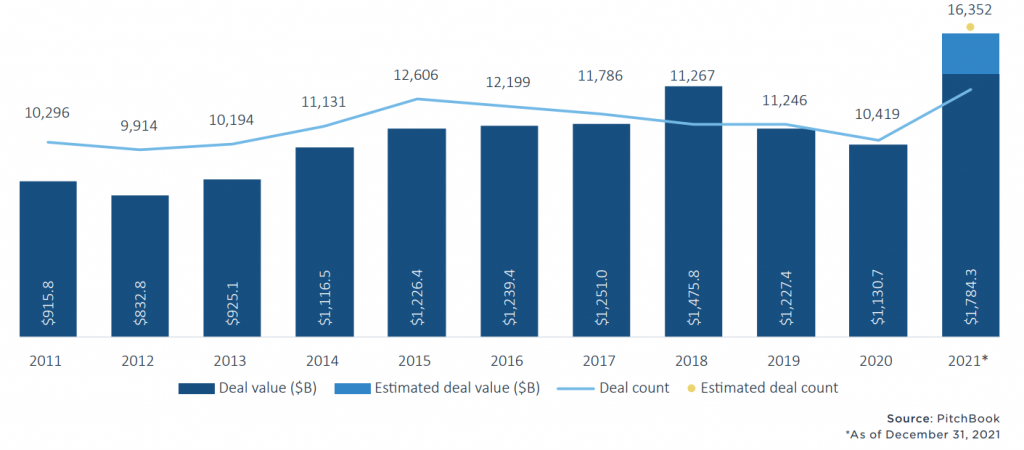

According to a Pitchbook report, European M&A value and volume shouted to new annual records in 2021. Approximately 16,352 deals closed, collectively worth $1.8 trillion—marking YoY increases of 56.9% and 57.8%, respectively. 2021 powered past the previous highs of $1.5 trillion set in 2018 and 12,650 deals set in 2015.

In 2022 buyers will want to focus on digitizing their businesses, which will help navigate M&A activity despite macro concerns. Regions in Europe including DACH and the UK & Ireland are expected to see the biggest rises in M&A activity in 2022, according to CMS Law. Meanwhile, the German government is focusing on digitizing and making Germany greener, which should promote more M&A opportunities.

The number of M&A deals in the CEE region rose to 889 in 2021, up 32% from the previous year according to Mazars. The total deal value was also higher, with transactions totalling €67.5bn.

What will 2022 bring for M&A?

In 2022 venture industry is at a crossroads. M&A and venture industry is facing headwinds including public market volatility, and interest rate hikes as the war in Ukraine shifts VC away from its constant growth trajectory. Deal value totalled $70.7 billion in Q1, the lowest figure since 2020, and IPOs came nearly to a halt.

According to Reuters, the value of global merger and acquisition (M&A) activity took a 29% hit in the first quarter of 2022. Overall deal volumes fell to $1.01 trillion from $1.43 trillion in the first quarter of 2021, according to Dealogic data. Dragged down by a similar 29% drop in crossborder transactions, geopolitical tensions forced large companies to take a pause. Companies had to postpone their pursuit of large strategic buyouts.

European volumes were down 25% to $227.67 billion.

Dealmaking in the technology sector continued to lead the way, even though overall volumes were lower compared to last year. Healthcare activity declined by more than half. Part of the reason is that large pharma companies adopted a more cautious strategic approach. That is due to the market volatility caused by geopolitical tensions.

A number of big companies in tech rushed to exit Russia and decided not to use their cash for large buyouts. In the meantime, activist investors stepped up the pressure on boards to pursue sale processes or break-ups. They want to unlock more value for investors at a time when public market valuations are at lower levels.

However, despite the increased volatility and macro concerns, a new activity is still on the horizon. Experts hope deal activity to pick up again once geopolitical tensions are resolved. Nevertheless, deals are likely to be smaller in size. Also, they will need to factor in their companies’ exposure to gas and commodities prices.